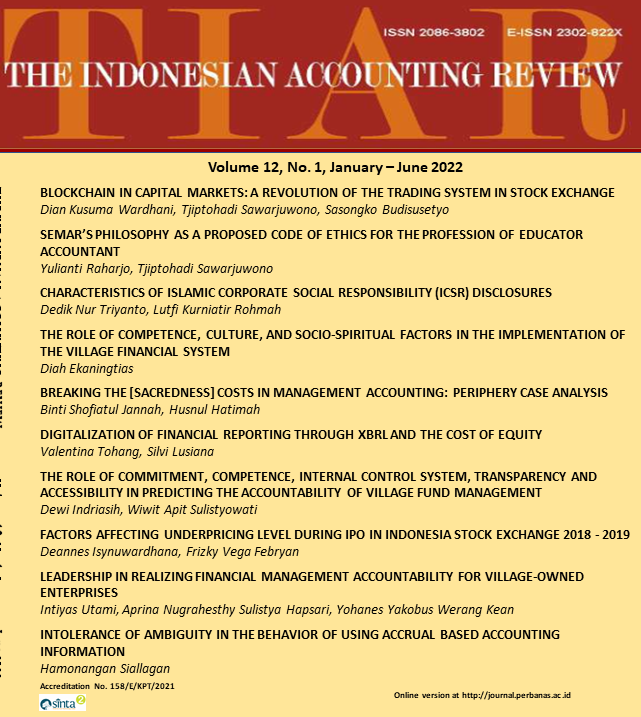

Factors Affecting Underpricing Level during IPO in Indonesia Stock Exchange 2018 - 2019

DOI:

https://doi.org/10.14414/tiar.v12i1.2660Keywords:

Underpricing, return on asset, financial leverage, earning per share, current ratioAbstract

The underpricing is an event that occurs when stock price in a primary market is smaller than that on secondary market. Indonesia has an increase of companies that experience underpricing every year, although there was a decline in 2019/ Yet, the decline was not significant. The purpose of the study was to determine the effect of factors such as company age, company size, and return on assets, financial leverage, earnings per share and current ratio on level of underpricing at the time of Initial Public Offering (IPO) on the Indonesia Stock Exchange for the period 2018-2018. This research was conducted on the companies that did an IPO on the IDX for the period 2018-2019 using method purposive sampling. There were 82 companies used and the method used was multiple linear regression analysis using SPSS software. The results showed that company size and earnings per share have a negative effect on the level of underpricing. However, the company age, return on assets, financial leverage and current ratio have no effect on the level of underpricing. This research expected to provide benefits to related parties, including for investors. Investors can consider the value of earnings per share and the size of the company when making investment. for issuers companies need to pay attention to value of Earning Per Share and the size of the company so it avoid underpricing and get expected profit for the company.

References

Akbar, D. A., & Africano, F. (2020). Pengaruh Reputasi Underwriter Dan Umur Perusahaan, Terhadap Underpricing Saham Pada Saat Initial Public Offering. Jurnal Al-Qardh, 4(2), 129–141. https://doi.org/10.23971/jaq.v4i2.1660

Andari, B., & Saryadi. (2020). Pengaruh Return On Asset ( ROA ), Debt To Equity Ratio ( DER ), Ukuran Perusahaan , Umur Perusahaan , Jenis Industri dan Reputasi Underwriter Terhadap Underpricing Sahamaham pada Perusahaan IPO di Bursa Efek Indonesia Periode (2016-2018) Jurnal Ilmu Administrasi Bisnis, 9(4), 496–506.

Ayuwardani, R. P., & Isroah, I. (2018). Pengaruh Informasi Keuangan dan Non Keuangan Terhadap Underpricing Harga Saham pada Perusahaan Yang Melakukan Initial Public Offering (Studi Empiris Perusahaan Go Public yang terdaftar di Bursa Efek Indonesia Tahun 2011-2015). Nominal, Barometer Riset Akuntansi Dan Manajemen, 7(1).

Brown, S. and Hillegeist, S. A. (2007) How Disclosure Quality Affects The Level of Information Asymmetry, Review of Accounting Studies, 1–53.

Darpius, Agustin, H., & Sari, V. F. (2019). Pengaruh Financial Leverage, Profitabilitas, Dan Besaran Penawaran Saham Terhadap Initial Public. Akuntansi, 1(1), 9.

Dewi, K. M. S., Tripalupi, L. E., & Haris, I. A. (2018). Pengaruh Return on Equity(Roe) Dan Earning Per Share (EPS) Terhadap Underpricing Pada Saham Perdana di Bursa Efek Indonesia Tahun 2016. Jurnal Pendidikan Ekonomi Undiksha, 10(1), 200. https://doi.org/10.23887/jjpe.v10i1.20115

Ghozali, I. (2016). Aplikasi Analisis Multivariete Dengan Program IBM SPSS 23.Badan Penerbit Universitas Diponegoro.

Nurazizah, N. D., & Majidah. (2019). Analisis Faktor-Faktor Yang Mempengaruhi Underpricing Pada Saat Initial Public Offering (Ipo) Di Bursa Efek Indonesia Periode 2010-2012. Diponegoro Journal of Accounting, 0(0), 747–756. https://doi.org/10.31955/mea.vol4.iss1.pp157-167.

Kartika, Gusti A. S., & Putra, I Made P. D. (2017). Faktor-Faktor Underpricing Initial Public Offering Di Bursa Efek Indonesia. E-Jurnal Akuntansi, 19(3), 2205–2233.

Kasmir. (2017). Analisis Laporan Keuangan. Raja Grafindo Persada.

Manurung, S. T. A., & Nuzula, N. F. (2019). Pengaruh Variabel Non Keuangan terhadap Underpricing pada saat Initial Publi Offering ( IPO ) ( Studi pada Perusahaan yang Listing di Bursa Efek Indonesia Periode 2015-2018 ). Jurnal Administrasi Bisnis (JAB), 69(1), 58–66. administrasibisnis.studentjournal.ub.ac.id%0A58

Maulidya, P. S., & Lautania, M. F. (2016). Pengaruh Asset Turnover, Current Ratio, Debt To Equity Ratio, Dan Ukuran Perusahaan Terhadap Terjadinya Underpricing Saham Pada Perusahaan Di Pasar Penawaran Saham Perdana Yang Terdaftar Di Bursa Efek Indonesia Tahun 2010-2014. Jurnal Ilmiah Mahasiswa Ekonomi Akuntansi (JIMEKA), 1(1), 171–182.

Nadia, R., & Daud, R. M. (2017). Pengaruh Informasi Keuangan dan Non Keuangan terhadap Initial Return pada Perusahaan yang Melakukan Penawaran Umum Saham Perdana di Bursa Efek Indonesia Periode 2014-2016. Jurnal Ilmiah Mahasiswa Ekonomi Akuntansi (JIMEKA), 2(3), 1.

Putra, I., & Sudjarni, L. (2017). Pengaruh Reputasi Underwriter, Ukuran Perusahaan, Dan Jenis Industri Terhadap Underpricing Saat Ipo Di Bei. E-Jurnal Manajemen, 6(1), 492–520.

Rudangga Gede Ngurah Gusti I & Sudiarta Merta Gede. (2016). Pengaruh UkuranPerusahaan, Leverage, dan Profitabilitas Terhadap Nilai Perusahaan. E- Jurnal Manajemen Unud. Vol 5 No7 2016: 4394-4422. ISSN : 2302-8912.

Sekaran, Uma &Bougie,Roger. (2017).Metode Penelitian untuk Bisnis: Pendekatan Pengembangan-Keahlian, Edisi 6, Buku 1, Cetakan Kedua, Salemba Empat, Jakarta Selatan 12610.

Setya, V. A., & Fianto, B. A. (2020). Pengaruh Variabel Keuangan Dan Non-Keuangan Terhadap Underpricing Saham Pada Perusahaan Jasa Saat Initial Public Offering (Ipo) Di Bursa Efek Indonesia (Bei): Studi Kasus Pada Saham Syariah Dan Non Syariah Periode 2012-2017. Jurnal Ekonomi Syariah Teori Dan Terapan, 7(5), 886. https://doi.org/10.20473/vol7iss20205pp886-900.

Setyowati, T. K., & Suciningtyas, S. A. (2018). Analisis Tingkat Underpricing Saham Pada Perusahaan yang Melakukan Penawaran Saham Perdana (IPO) di BEI Periode 2012-2016. Jurnal Universitas Islam Sultan Agung Semarang, 19, 89–98. http://jurnal.unissula.ac.id/index.php/ekobis/article/download/2929/2134.

Sulistyawati, P. I., & Wirajaya, I. G. A. (2017). Pengaruh Variabel Keuangan, Non Keuangan, dan Ekonomi Makro Terhadap Underpricing Pada IPO di BEI. E-Jurnal Akuntansi Universitas Udayana, 20(3), 1848–1874.

Tandelilin, E. (2010). Portofolio dan Investasi Teori dan Aplikasi (1st ed.). Kanisius.

Wiyani, N. (2016). Underpricing pada Initial Public Offering (Studi Empiris pada Perusahaan Non Keuangan yang Go Public di Bursa Efek Indonesia Tahun 2011 - 2014). Jurnal Online Insan Akuntan, 1(2), 341–358.

Yuniarti, D., & Syarifudin, A. (2020). Pengaruh Leverage, Profitabilitas dan Ukuran Perusahaan Terhadap Underpricing pada Saat Initial Public Offering. Jurnal Ilmiah Mahasiswa Manajemen, Bisnis Dan Akuntansi (JIMMBA), 2(2), 214–227. https://doi.org/10.32639/jimmba.v2i2.464.

Downloads

Submitted

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 The Indonesian Accounting Review

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.