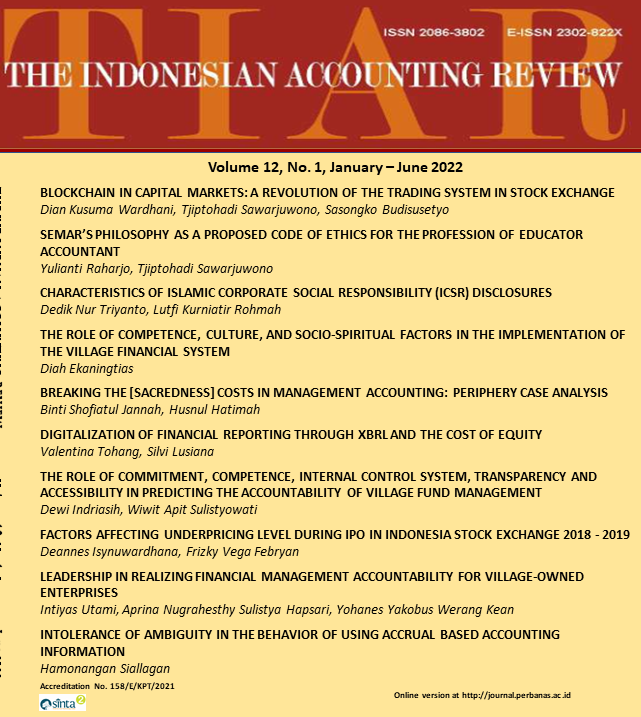

Characteristics of Islamic Corporate Social Responsibility (ICSR) Disclosures

DOI:

https://doi.org/10.14414/tiar.v12i1.2605Keywords:

ICSR, Public share holding, Size, leverage, Profitability, Corporate GovernanceAbstract

The company’s CSR activities illustrate that, in addition to carrying out its operational activities, the company is also responsible for the sur-rounding environment. This sharia-based social performance reporting is assessed based on the sharia index developed by AAOFI (Accounting and Auditing Organization for Islamic Financial Institutions). The purpose of this study was to determine the effect of public share ownership, firm size, leverage, profitability, and corporate governance on the disclosure of Islamic Corporate Social Responsibility (ICSR). The sample was taken from 12 sharia companies registered in the Jakarta Islamic Index (JII) for the 2015-2020 period using a purposive sampling technique. The data were analysed using panel data regression analysis through the EViews 11 application. Firms and profitability affect Islamic Corporate Social Responsibility (ICSR) disclosures, and public share ownership has a negative effect on ICSR disclosures, while leverage and corporate governance variables do not affect Islamic Corporate Social Responsibility (ICSR) disclosures. Based on the results of this study, it is expected that elements in corporate governance can carry out their duties and responsibilities in carrying out their duties so that ICSR disclosure is carried out better.

References

Bimaswara, Suzan, L., & Mahardika, D. P. K. (2018). Pengaruh Ukuran Perusahaan, Likuiditas, Risiko Keuangan, dan Profitabilitas terhadap Pengungkapan Tanggung Jawab Sosial (Studi Pada Perusahaan Tekstil dan Garmen yang Terdaftar di BEI Tahun 2013-2016). E-Proceeding of Management, 5(2), 2425. https://openlibrarypublications.telkomuniversity.ac.id/index.php/management/article/view/6858

Budi, I. S., Rahmawati, Falikhatun, Muthmainah, & Gunardi, A. (2019). Financial Performance Mediation in the Influence of Islamic Corporate Governance Disclosure on the Islamic Social Reporting. Indonesian Journal of Sustainability Accounting and Management, 3(1). https://doi.org/10.28992/ijsam.v3i1.77

Fitranita, V., & Wijayanti, I. O. (2020). Profitabilitas, Ukuran Perusahaan, Kinerja Lingkungan, Pertumbuhan Penjualan dan Leverage pada Pengungkapan Islamic Corporate Social Reporting. JAF- Journal of Accounting and Finance, 4(1), 29. https://doi.org/10.25124/jaf.v4i1.2344

Ghozali, P. D. I. (2020). 25 Grand Theory (Teori Besar Ilmu Manajemen, Akuntansi dan Binis) (Apriya (ed.); viii). Yoga Pratama.

Hamdani, S. P., Yuliandari, W. S., & Budiono, E. (2017). Kepemilikan Saham Publik dan Return on Assets terhadap Pengungkapan Corporate Social Responsibility. JRAK, 9(1), 47. https://doi.org/10.23969/jrak.v9i1.368

Hery. (2016). Analisis Laporan Keuangan Pendekatan Rasio Keuangan. Center of Academic Publishing Service.

Indrawati. (2015). Metodologi Penelitian Manajemen dan Bisnis: Konvergensi Teknologi Komunikasi dan Informatika. Refika Aditama.

Jannah, A. M., & Asrori. (2016). Pengaruh GCG, Size, Jenis Produk Dan Kepemilikan Saham Publik Terhadap Pengungkapan ISR. Accounting Analysis Journal, 5(1), 1–9. https://doi.org/10.15294/aaj.v5i1.9758

Kurniawati, M., & Yaya, R. (2017). Pengaruh Mekanisme Corporate Governance, Kinerja Keuangan dan Kinerja Lingkungan terhadap Pengungkapan Islamic Social Reporting. Jurnal Akuntansi Dan Investasi, 18(2), 163–171. https://doi.org/10.18196/jai.180280

Kusuma, H. N. (2016). Pengaruh Ukuran Perusahaan,Leverage, Dan Kepemilikan Saham Publik Terhadap Luas Pengungkapan Csr Pada Perusahaan di Sektor Pertambangan Yang Terdaftar Di Bei Tahun 2014-2015. Jurnal Ilmiah Mahasiswa FEB Universitas Brawijaya, 5(2). https://jimfeb.ub.ac.id/index.php/jimfeb/article/view/4124

Mukhibad, H. (2018). Peran Dewan Pengawas Syariah dalam Pengungkapan Islamic Social Reporting. Jurnal Akuntansi Multiparadigma, 9(2), 299–311. https://doi.org/10.18202/jamal.2018.04.9018

Novrizal, M. F., & Fitri, M. (2016). Faktor-Faktor yang Mempengaruhi Pengungkapan Corporate Social Responbility (CSR) pada Perusahaan yang Terdaftar di Jakarta Islamic Index (JII) tahun 2012-2015 dengan Menggunakan Islamic Social Reporting (ISR) Index sebagai Tolok Ukur. Jurnal Ilmiah Mahasiswa Ekonomi Akuntansi (JIMEKA), 1(2), 177–189. https://www.neliti.com/id/publications/187953/faktor-faktor-yang-mempengaruhi-pengungkapan-corporate-social-responbility-csr-p

Nugraheni, P. (2018). Sharia supervisory board and social performance of Indonesian Islamic banks. Jurnal Akuntansi & Auditing Indonesia, 22(2), 137–147. https://doi.org/10.20885/jaai.vol22.iss2.art6

Nugraheni, P., & Permatasari, D. (2016). Perusahaan syariah dan pengungkapan corporate social responsibility: Analisis pengaruh faktor internal dan karakteristik perusahaan. Jurnal Akuntansi & Auditing Indonesia, 20(2), 136–146. https://doi.org/10.20885/jaai.vol20.iss2.art6

Qoyum, A., Mutmainah, L., Setyono, J., & Qizam, I. (2017). The Impact of Good Corporate Governance, Company Size nn Corporate Social Responsibility Disclosure: Case Study of Islamic Banking in Indonesia. IQTISHADIA, 10(1). https://doi.org/http://dx.doi.org/10.21043/iqtishadia.v10i1.2365

Rahayu, P., & Aniskurillah, I. (2015). Pengaruh Kepemilikan Saham Publik, Profitabilitas Dan Media Terhadap Pengungkapan Tanggung Jawab Sosial. Accounting Analysis Journal, 4(3), 1–9. https://doi.org/https://doi.org/10.15294/aaj.v4i3.8300

Rahayu, R. S., & Cahyati, A. D. (2014). Faktor-Faktor yang Mempengaruhi Pengungkapan Corporate Social Responsibility (CSR) pada Perbankan Syariah. Jurnal Riset Akuntansi & Komputerisasi Akuntansi, 5(2), 74–57.

Riyani, D., & Uswati Dewi, N. H. (2018). The effect of corporate governance, leverage, and liquidity on islamic social reporting (ISR) disclosure in islamic commercial banks in Indonesia. The Indonesian Accounting Review, 8(2), 121. https://doi.org/10.14414/tiar.v8i2.1628

Sawitri, D. R., Juanda, A., & Jati, A. W. (2017). Analisis Pengungkapan Corporate Social Responsibility Perbankan Syariah Indonesia Berdasarkan Islamic Social Reporting Index. Kompartemen: Jurnal Ilmiah Akuntansi, 15(2). https://doi.org/10.30595/kompartemen.v15i2.1876

Usmar, D. (2014). Analisis faktor-faktor yang mempengaruhi islamic social reporting (isr) dan implikasi islamic social reporting terhadap kualitas laba (earnings quality). Jurnal Wawasan Dan Riset Akuntansi, 2(1), 1–22.

Wahyono, W., Putri, E., & Cahya, B. T. (2020). Corporate Governance Strength, Firm’s Characteristics, and Islamic Social Report: Evidence from Jakarta Islamic Index. Journal of Accounting and Investment, 21(2), 383–400. https://doi.org/10.18196/jai.2102155.

Wahyuningsih, Ana & Machdar, Nera Marinda (2018). Pengaruh Size, Leverage dan Profitabilitas Terhadap Pengungkapan CSR Pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia. Jurnal Bisnis dan Komunikasi.

Downloads

Submitted

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 The Indonesian Accounting Review

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.